Despite strong box office results and healthy food and beverage sales, AMC stock shares have continued to fall. AMC is now focusing on reorganizing its balance sheet by converting its AMC Preferred Equity units into common stock and doing a reverse stock split.

Meme stocks like GameStop and AMC were once popular investments, but many of those investors have been burned by the collapse in their stocks this year. AMC is struggling to raise enough cash to pay down its debt, while navigating a slow-to-recover movie industry.

What Is AMC Entertainment?

As the largest theatrical exhibition company in the world, AMC Entertainment operates more than 200 theaters with 2,800 screens across 23 states. As of 2000, the company generated approximately $9 billion in annual ticket sales. The company’s flagship brand, AMC Theatres, is the nation’s leading chain of movie theaters and offers a variety of movie viewing options, from standard single-screen and IMAX cinemas to dine-in and reclining theatres. AMC’s AMC Classic brand features independent and foreign films, and its AMC Holiday Theaters feature a mix of holiday family movies and traditional classics.

The founder and chairman of AMC, Stanley Durwood, was a master of the multi-screen movie experience. His vision and commitment to quality, innovation, and customer service allowed the company to grow into one of the most prominent movie theater companies in the world during the late 1980s.

AMC’s strategy of building complexes with eight to 12 screens was a departure from the standard five-screen theaters that dominated the industry. Durwood’s new buildings targeted smaller cities in sunbelt states, where he believed his business would prosper. To finance his aggressive expansion, Durwood took on large amounts of debt, hoping to pay it off in the long run with strong profit gains.

Despite soaring costs and debt, AMC was still able to generate impressive earnings during the late 1980s and early 1990s. However, by 1992, the company’s debt load was eating away at its cash flow, and the company began to lose money year after year.

AMC restructured its business in 1994, closing 40 of its less-profitable theaters and laying the groundwork for its next phase of growth. Management was optimistic that sales, which had surged to a record level in the fiscal year ended March 31, could continue climbing. Until then, AMC was working hard to keep its balance sheet in order.

What Is AMC Entertainment’s Business Model?

AMC Entertainment’s business model is based on operating movie theaters and selling tickets. The company has over 9,500 locations in the US and has 10,600 screens. It is one of the largest theater operators in the world. The company’s business model is centered on offering a family-friendly environment and showing popular films. It also offers food and beverage services to its customers. The company’s revenue is derived from ticket sales and concession sales. It also has a loyalty program that rewards its customers with points for every purchase.

In the past year, AMC’s revenues have remained depressed due to the COVID-19 pandemic. Revenues have dipped by about 77% from the previous year’s levels. However, analysts expect a rebound in revenues in the near future as people return to movie theaters. In the meantime, AMC has been investing in innovative ways to diversify its offerings beyond traditional cinemas. For instance, the company offers viewings of sports events and will soon accept cryptocurrency as a form of payment for movie tickets and refreshments.

The company has also been cutting costs to offset its declining revenues. This has helped it preserve cash and improve its balance sheet. As a result, the company is expected to be able to reduce its debt burden and increase earnings per share in 2022.

It’s important for investors to understand the factors that influence AMC Entertainment’s valuation. These include revenue growth, profitability, and future potential. This can help them determine if the stock is a good investment.

Revenue is an essential metric when evaluating a business’s financial health. It is calculated by adding up all of the firm’s operating income and subtracting its operating expenses from that number. Revenue can be influenced by a variety of factors, including economic conditions, consumer demand, and competitive dynamics.

AMC’s revenue has been impacted by the ongoing pandemic, which has significantly reduced the number of people visiting movie theaters. As a result, the company’s profits have declined significantly in recent years. This has made some investors hesitant to invest in the company. However, the company has been able to boost its revenue in recent weeks thanks to the reopening of theaters and the release of new movies.

What Is AMC Entertainment’s Financial Performance?

There are many tools investors use to determine the financial health of a business. These tools include the company’s revenue, profit margin, cash flow, liquidity, solvency, growth potential, and more. Another important tool is the company’s financial leverage, which measures its debt ratio against its assets. This helps investors understand how much risk is associated with holding a particular stock.

Investor sentiment is also a crucial factor in determining the probability of a stock’s price appreciation or decline. This can be determined by analyzing public news, social media activity, and other sources. In general, stocks with higher Investor Sentiment scores are more likely to rise in value over time.

One way to measure investor sentiment is by looking at a stock’s short interest history. This metric indicates how many shares are currently being sold short by professional and individual investors. When a stock’s short interest is high, it means that there are a lot of people betting on a decline in the stock’s price. If a stock’s price starts to rise, these short sellers will need to cover their positions by buying back shares. This can cause a chain reaction of buying that can push the stock’s price even higher.

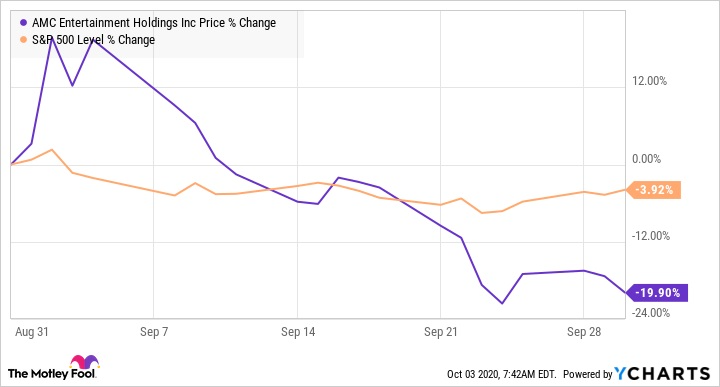

AMC’s stock got knocked hard after it settled a lawsuit against shareholders regarding the company’s plan to convert its AMC Entertainment Preferred Units (APEs) into common shares. AMC stock tanked 23% on April 4 before rebounding. It’s now trading just above its January low.

Nevertheless, the company’s overall financial performance is still solid. It has a good cash position with $843 million in operating cash, and its net income was up 35% compared to the previous year. Its debt-to-assets ratio stands at 0.35, which is lower than the industry average of 0.4. In addition, its dividend payout is a decent 6.4% of earnings per share.

What Is AMC Entertainment’s Future Prospects?

AMC has made a lot of changes, trying to turn its troubled business into a solid money-making machine. But the theater chain operator has a long way to go before it can make investors confident about its future prospects.

AMC’s earnings report in early February highlighted some encouraging signs for its turnaround plan. The theater operator reported a much narrower fourth-quarter loss than the previous year and topped analysts’ estimates for both revenue and earnings per share.

The theater operator also made a big splash with its new value-pricing plan, Sightline at AMC, which offers ticket prices based on a viewer’s sightline of the movie screen within the auditorium. The move was designed to appeal to families and people who don’t want to pay astronomical ticket prices for the privilege of watching a movie in a high-definition format.

But AMC’s shaky financial position is a major concern for anyone thinking about buying the stock. The theater chain has massive debt leverage and chronically negative working capital. Its colossal cash raise in 2020 greatly improved its working capital balance, but it’s likely that even with healthy box office revenue growth, AMC will struggle to cover interest expenses and repay its debt.

AMC has some promising ideas on its table to get its business back on track, but whether any of them pan out and prove profitable is a question mark. On the call with analysts, CEO Adam Aron outlined six new strategies he’s trying to implement to improve the company.

Aron also mentioned that the company has developed a non-fungible token, or NFT, for moviegoer attendance. NFTs are a new kind of digital asset that can be traded on a secondary market for virtual goods or services. They’re popular among video game enthusiasts and are increasingly being used as a form of currency in the cryptocurrency market.

But even if the theater chain’s NFT idea works out, I don’t think AMC can avoid bankruptcy unless it can attract enough investors willing to overvalue its stock and pump in lots of capital. Even then, I doubt AMC can overcome the negative effects of the secular decline in theater admissions and its chronically negative operating cash flow.

Conclusion

As an AI language model, I can provide some general information related to the financial health of a company.

AMC is a movie theater chain that has been significantly impacted by the COVID-19 pandemic, which resulted in the closure of many theaters and reduced demand for movie-going. As a result, AMC has faced financial challenges over the past year.

Here are some FAQs related to the financial health of a company:

Q: How can I evaluate a company’s financial health?

A: There are several financial metrics that can be used to evaluate a company’s financial health, including revenue, profit margin, return on equity, debt-to-equity ratio, and cash flow, among others. It is important to look at a variety of financial metrics to get a complete picture of a company’s financial health.

Q: What financial challenges has AMC faced?

A: AMC has faced significant financial challenges as a result of the COVID-19 pandemic, which led to the closure of many theaters and reduced demand for movie-going. The company has had to take on additional debt to stay afloat and has experienced significant losses.

Q: How has AMC responded to its financial challenges?

A: AMC has taken several steps to address its financial challenges, including issuing new shares to raise capital, renegotiating lease agreements with landlords, and seeking government aid. The company has also focused on reducing costs, such as by furloughing employees and cutting executive pay.

Q: Is AMC a good investment based on its financial health?

A: As an AI language model, I cannot provide financial advice. It is important to consider a variety of factors, including a company’s financial health, market conditions, and your own investment goals and risk tolerance when evaluating potential investments. It is best to consult with a financial advisor and do your own research before making any investment decisions.